Why is python so useful in finance ? Why should finance students learn python? Is python necessary to learn as a finance student ? This blog explains the importance of python in the finance industry and uses in the finance sector . You will also learn free resources to master python for finance .

Python is a high level programming language , uses simple English words in the code which can be easily understood by humans . It is a trending programming language which is easy to learn and use . It is an open source language which means anyone can make changes according to their needs . Python has a larger community rather than other languages which helps beginners to take guidance and resolve any problems while writing code .

Contents

- 1 History of Python in Finance

- 2 Beginners friendly Language – Why is python so useful in finance ?

- 3 Python Libraries for Finance – Why is python so useful in finance ?

- 4 Data Analysis and Visualization

- 5 Automation of Financial Tasks

- 6 Risk Management

- 7 Financial Forecasting

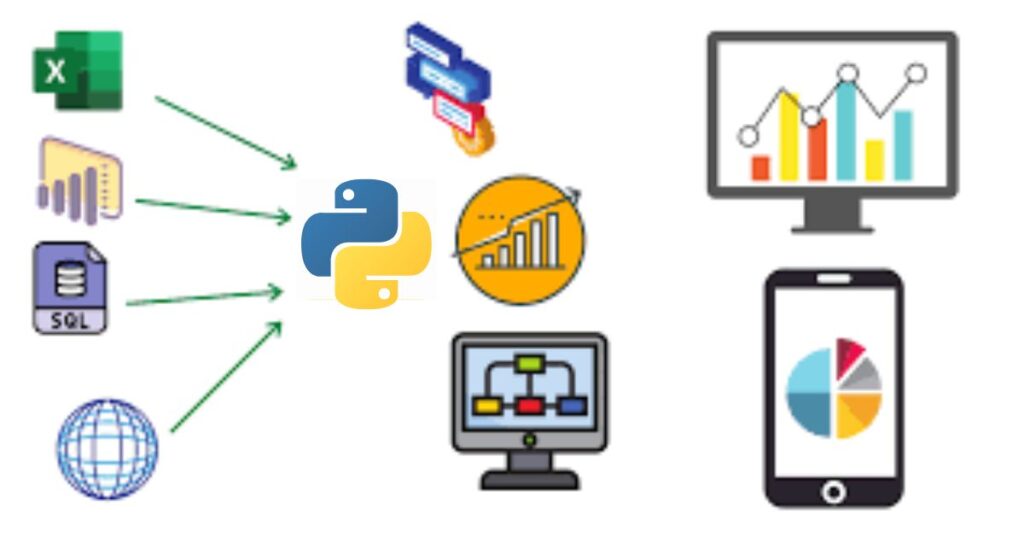

- 8 Integration with Other Technologies

- 9 Case Studies

- 10 Guidance for Finance Students

- 11 Conclusion

- 12 FAQs

History of Python in Finance

Python is an interpreted , high-level programming language known for its simple and readable code . It was Created by Guido van Rossum in 1991 , Python has grown to become one of the most popular programming languages in the world . Its design emphasizes code readability with its noticeable use of important indentation.

Python started becoming important in finance around the early 2000s . Back then , people who worked with money , like banks and stock markets, wanted to find easier ways to write computer programs . They were using older languages like C++ and Java, which were harder to learn and use.

Beginners friendly Language – Why is python so useful in finance ?

One of the Important advantages of python is its beginner – friendly and no need of programming background to the learners . As it uses high level language which means in english , it is easy to understand and implement . Finance students can easily learn python because it has a larger python community . If you are stuck in any part you can just search in google as there is always help from python professionals .Python is an interpreted language , which means you can run the code directly without needing to compile it first . This makes testing and trying out new ideas quicker .

Python Libraries for Finance – Why is python so useful in finance ?

Python’s extensive library ecosystem is a goldmine for finance professionals . Some essential libraries include :

- Pandas: For data manipulation and analysis .

- NumPy: For numerical computations .

- Matplotlib and Seaborn: For data visualization .

- SciPy: For scientific and technical computing .

- Statsmodels: For statistical modeling .

- Scikit-learn: F or machine learning .

These libraries provide robust tools for everything from data analysis to building complex financial models .

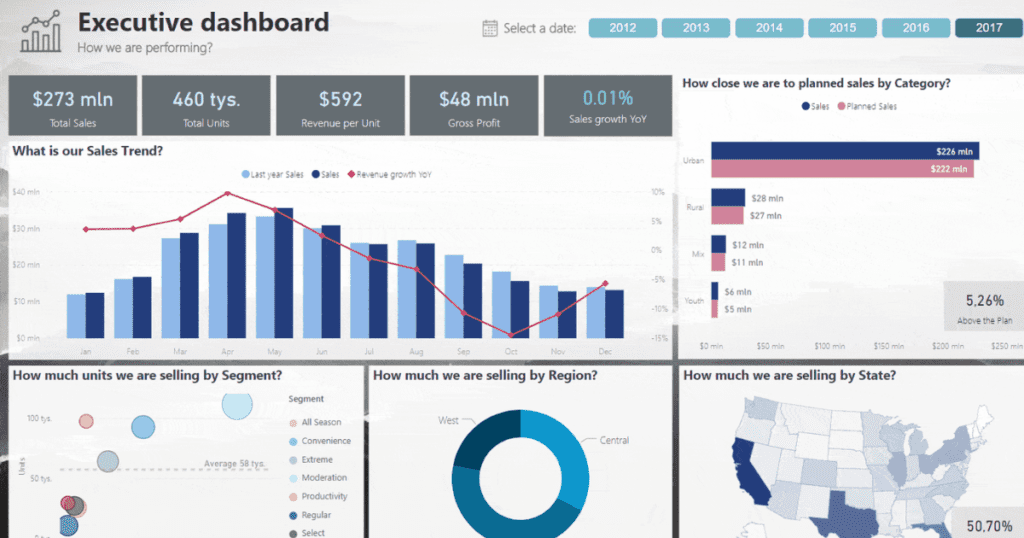

Data Analysis and Visualization

In finance , data is king . Python has powerful libraries like Pandas and NumPy that make it easy to manipulate and analyze large datasets . Visualization tools like Matplotlib and Seaborn help in creating insightful charts and graphs , allowing analysts to make data-driven decisions . One more important use of python is it can be integrated with data visualization tools like Power bi . Whether it’s historical stock prices , market trends , or financial statements , Python makes data analysis a breeze .

Automation of Financial Tasks

Repeating tasks can take a lot of time . Python can automate these tasks , increasing efficiency and reducing errors . For example , Python scripts can be used to automate data collection from various sources , process and clean the data , and even generate reports . This automation allows financial professionals to focus on more important strategic activities .

Risk Management

Risk management is very important in finance , and Python provides various tools to help with this . By analyzing historical data and market trends , Python can help identify potential risks and develop strategies to inform them . Libraries like SciPy and Statsmodels are particularly useful for risk analysis and modeling .

Financial Forecasting

Predictive analytics is a gamechanger in finance . Python has machine learning libraries , such as Scikit-learn , which allow for the development of sophisticated models to forecast financial trends . Whether it’s predicting stock prices or knowing future market conditions , Python’s capabilities in financial forecasting are unparalleled .

Integration with Other Technologies

Python’s ability to integrate with other technologies is another reason for its widespread use in finance . It can easily interact with databases , web services , and other coding languages , enhancing the capabilities of financial systems . This integration allows for the creation of extensive and wholesome financial solutions .

Case Studies

Real world examples of Python in finance highlight its practical applications and success . For example , investment banks use Python for risk management and trading strategies . Hedge funds use Python for data analysis and algo trading . These case studies demonstrate Python effectiveness and versatility in solving complex financial problems .

Guidance for Finance Students

Why should finance students learn python? – Finance students always get confused on what to learn in Python , where to start and what modules are helpful as an Equity Research analyst . So, follow my learning pattern. It will take a maximum of 30 days to learn all these perfectly .

1. Basic Python Programming:

- Variables, Data Types, and Operators

- Control Flow (if, else, loops)

- Functions

- Data Structures (lists, tuples, dictionaries, sets)

2. Python Libraries for Finance:

- NumPy (numerical computing)

- Pandas (data manipulation)

- Matplotlib and Seaborn (data visualization)

- Statsmodels and Scikit-Learn (statistical analysis and machine learning)

3. Financial Data Handling:

- APIs for fetching financial data

- Handling different data formats (CSV, JSON, Excel)

- Time Series Data Analysis

4. Financial Analysis and Modeling:

- Calculating Financial Metrics (e.g., Sharpe ratio, P/E ratio)

- Risk Analysis Techniques

- Financial Modeling (e.g., DCF Models)

5. Practice projects

Do projects which make you an expert in python . You will learn many new things and get exposed to top jobs . Create 5-10 projects in your portfolio and show them in linkedin , indeed , and professional social gathering sites .

Conclusion

Impact of python on the financial industry is undeniable. It’s a crucial tool for finance which has Its ease of use , versatile , and powerful libraries make it an excellent tool for financial professionals . As technology continues to evolve , Python is ready to play an even more significant role in shaping the future of finance .

FAQs

- Why is Python preferred over other languages in finance?

Python’s simplicity, extensive libraries, and versatility make it a preferred choice for various financial applications.

- Can Python be used for high-frequency trading?

Yes, but performance optimization is necessary for very high-frequency trading applications.

- What are important Python libraries used in finance?

Pandas, NumPy, Matplotlib, SciPy, Statsmodels, and Scikit-learn are some commonly used libraries.

- Is Python suitable for financial forecasting?

Absolutely! Python’s machine learning libraries make it excellent for financial forecasting and predictive analytics.